Advantages of 401(k)

Unlock the Power of a 401(k)

Let’s be honest—stuffing cash under a mattress won’t grow your wealth, but a 401(k) can. With automatic payroll deductions and investment growth, it makes saving effortless. Whether building a secure future or creating a competitive workplace benefit, a 401(k) offers financial advantages that last.

Higher Contribution Limits

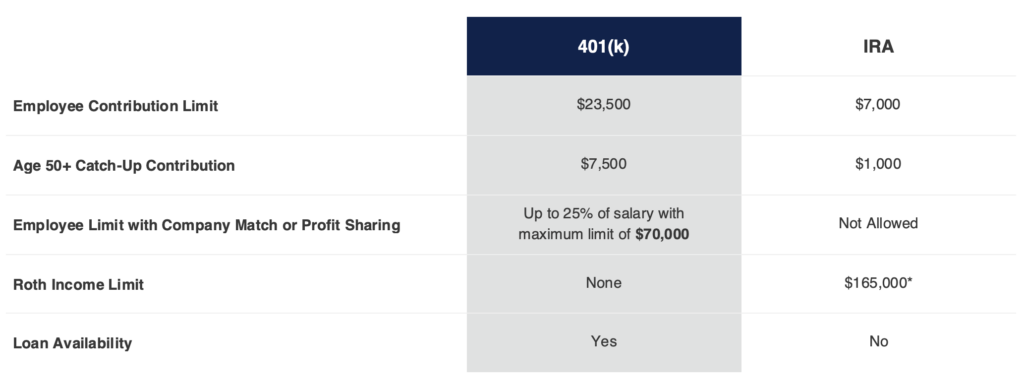

A 401(k) allows hard working Americans to contribute up to $23,500 per year—significantly more than an IRA. Those aged 50 or older can take advantage of an additional $7,500 in catch-up contributions, helping them save even more. Between age 60 and 63? You can contribute even more, thanks to SECURE Act 2.0.

Why a 401(k) Outshines a Traditional IRA

The maximum contribution for an employee in 2025 is $23,500 ($31,000 if age 50+).

*In 2025, the contribution amount allowed begins to decrease at $150,000 for single individuals, hitting $0 at $165,000. For those filing jointly the contribution limit begins to decrease at $236,000, hitting $0 at $246,0000.

Automatic Contributions & Investment Growth

A 401(k) enables seamless, automated savings through payroll deductions, ensuring consistency. Funds are invested with the potential for long-term tax-advantaged growth.

Loan Availability

Unlike IRAs, many 401(k) plans offer loan provisions, allowing participants to borrow from their balance if needed. This feature provides flexibility while keeping funds within the plan.

Find the Right Plan for Your Business or Nonprofit

NESA simplifies retirement planning by partnering with financial advisors, CPAs, recordkeepers, and industry professionals to create tailored workplace retirement solutions. From small businesses to mid-sized companies, nonprofits, and self-employed individuals, we help organizations provide meaningful retirement benefits—ensuring employees and business owners alike can save with confidence and peace of mind.