CONTRIBUTION LIMITS

IRS Limits

Employees can contribute to their employers 401(k) or 403(b) plans every year up to a certain IRS limit. Age 50 and older? You can put away more.

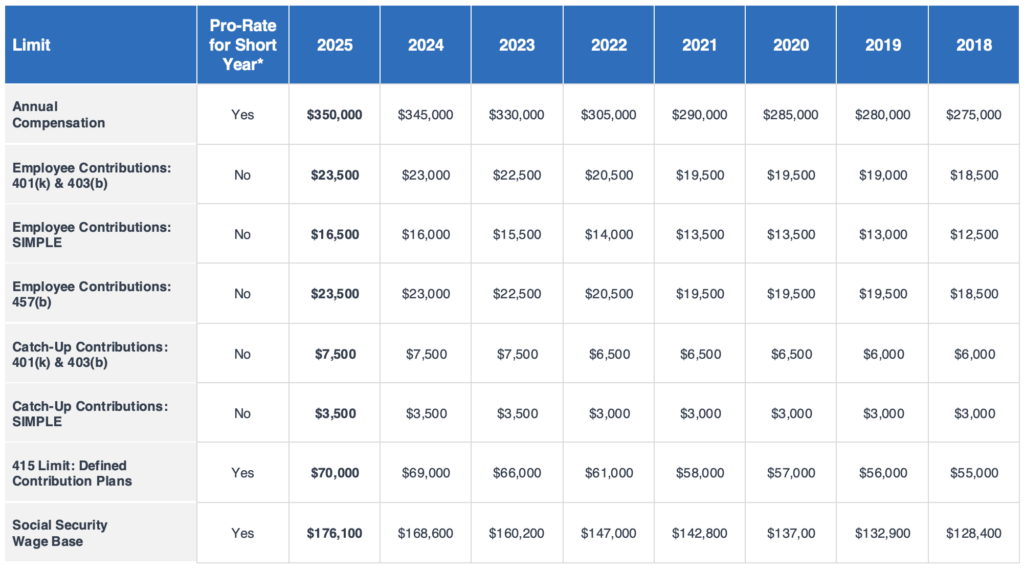

Historical Contribution & Testing Limits

Contribution Limits

Testing Limits

*For a plan year that is less than 12 months (either due to initially establishing the plan after the first of the year or terminating a plan before the end of the year), these limits must be pro-rated based on the number of months in the short plan year. For instance, a calendar plan year that runs from Jan. 1 through Aug. 31 would multiply the applicable limit by 8/12.

Have a Question – or Two? Go Ahead and Ask.