RETIREMENT PLAN 101

401(k) for Small Businesses, Medium-Sized Companies, and Self-Employed Individuals

Individuals in all professions should have access to retirement benefits. At NESA, we make it easy for employers to offer 401(k) to their staff with resources to succeed.

What is a 401(k)?

A 401(k) is an employer-sponsored retirement savings plan that helps both employees and business owners build a secure financial future. It’s a powerful tool for turning today’s earnings into tomorrow’s peace of mind, offering tax advantages, high contribution limits, and automatic payroll deductions to make saving easy. Plus, it gives businesses a competitive edge—helping attract top talent while supporting employees in reaching their retirement goals. Whether you’re growing a business or planning for your future, a 401(k) is a smart investment in long-term success.

How Does a 401(k) Work?

A 401(k) is like a retirement piggy bank that grows with each paycheck. Employees decide how much of their earnings to contribute—whether it’s a percentage or a fixed amount—each time they are paid. These contributions are automatically deducted and invested into a selection of retirement-focused funds chosen from the plan’s fund roster. The goal is to help the money grow over time, building a strong nest egg for retirement.

The best part? Taxes aren’t paid on the contributions until they are withdrawn in retirement. For those looking for a little extra flexibility, many 401(k) plans offer a Roth 401(k) option, where after-tax contributions are made, and those withdrawals are tax-free when the employee retires. Additionally, if an employer offers a match or other contributions, those funds are also tax-deferred, which is essentially like receiving free money for retirement.

Why a 401(k) is a Smart Move for Your Business?

Running a business is all about making smart financial decisions—both for today and the future. A 401(k) plan isn’t just a retirement perk; it’s a strategic tool that helps you attract top talent, keep employees happy, and even put more money back in your pocket. Let’s break down why a 401(k) might be one of the smartest investments you can make for your business.

Big Tax Breaks – Keep More Money in Your Business

Nobody likes paying more taxes than they have to. Luckily, a 401(k) can help you trim down that tax bill while putting money toward something meaningful—your business and your people. Here’s how it works:

• Tax-deductible contributions – Any money your company contributes to employee accounts reduces your taxable income.

• Write off administrative costs – The expenses of running your 401(k) aren’t just a business necessity—they’re a tax deduction.

• Extra tax credits – If you’re starting a new 401(k), you could qualify for up to $5,000 per year for the first three years to offset setup costs. That’s $15,000 in potential savings!

Flexibility to Fit Your Business Needs

Not all businesses are the same, so why should your retirement plan be one-size-fits-all? A 401(k) lets you tailor the details to fit your company’s culture and financial goals.

• Employer match (or not!) – You decide if and how much you want to contribute to employees’ accounts.

• Customize eligibility and vesting schedules – Set the rules on when employees qualify and how long they need to stay before fully owning their employer contributions.

• Traditional & Roth options – Let employees choose between tax-deferred savings now or tax-free withdrawals later.

Attract & Retain Top Talent – Stay Competitive

Hiring great people is tough. Keeping them? Even tougher. A 401(k) can be the difference between losing top talent and building a loyal team that sticks around.

• 61% of employees say they’d leave their job for a company with better retirement benefits.

• A strong 401(k) gives you an edge when recruiting against competitors.

• Employees who feel valued stay longer, reducing costly turnover and training expenses.

Portability & Long-Term Value – Set Yourself (and Your Business) Up for Success

Your business will evolve, and so will your employees. The good news? A 401(k) moves with them—and with you.

• If employees leave, they can roll their savings into another plan or IRA—no messy complications.

• What’s more? Employees can bring in savings from a previous employer’s 401(k) or an IRA, keeping everything in one place for easier management.

• Business owners can use a 401(k) for their own retirement, with high contribution limits that allow for serious savings over time.

• Thinking of selling or retiring? Your 401(k) can be part of your exit strategy, giving you financial security beyond the business.

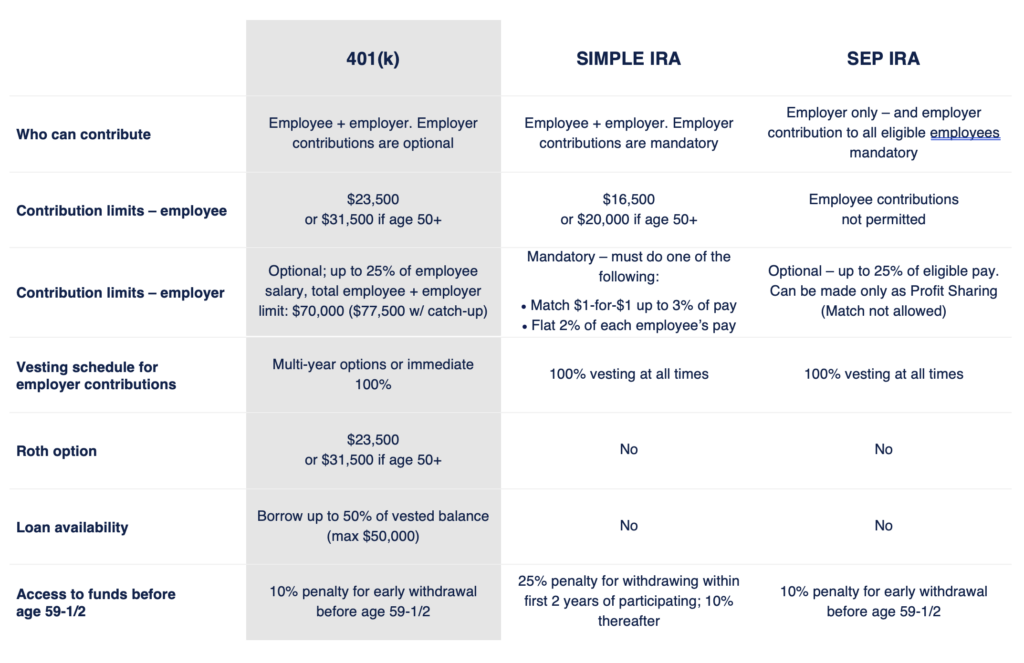

When comparing a 401(k) to SEP IRAs and SIMPLE IRAs, the differences are striking. 401(k) plans stand out with higher contribution limits and greater flexibility in design, allowing businesses to better manage costs and taxes. Plus, they provide the added benefit of penalty-free access to funds through loans in case of an emergency. Here’s a quick summary of how these plans stack up:

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.

1Investment Company Institute, March 2020