RETIREMENT PLAN 101

401(k) Profit Sharing Contributions: The Ins and Outs of a Great Benefit

Profit sharing contribution helps businesses lower taxes and rewards employees.

Profit sharing is the most flexible type of employer contribution a company can make to their employees under a 401(k) plan. These contributions are not only discretionary, but they can be made to any eligible employees – even if they do not contribute to the plan. They can also be allocated using dramatically different formulas – allowing employers to meet a broad range of 401(k) plan goals.

Quick Facts

- Profit sharing is typically made once a year and is completely optional.

- In addition to being tax deductible, profit sharing can help increase employee morale, retention and grow nest eggs.

- Employers can make both profit sharing and match in the same year.

- Profit sharing contribution can have vesting schedule -- so employees get full ownership once they work a certain number of years.

Benefits of Profit Sharing Contributions for Businesses

Here are five benefits to profit sharing.

1. It’s a bonus with tax advantages

One way to use profit sharing is as part — or all — of your employees’ year-end bonus. These bonuses boost your employees’ retirement savings without increasing their taxable income each year. Profit sharing contributions are also tax-deductible to the employer and aren’t subject to Social Security or Medicare withholding. As a year-end bonus, a profit sharing contribution may eventually be worth more to employees than a similarly-sized direct bonus payment.

2. The flexibility to plan your finances

Not sure if you can offer a potentially costly employee benefit? Profit sharing plans let you decide after the end of the year. Contributions must be made before the tax filing deadline (including extensions), and are still deductible on the previous year’s tax return. For example, your company can make a 2023 profit sharing contribution in 2024 before the tax return deadline and deduct it on its 2023 tax return.

3. Reward key employees

A profit sharing plan may allow you to make greater contributions to certain key staff without failing IRS compliance limits for nondiscrimination testing. Profit sharing contributions are not counted toward the IRS annual deferral limit of $22,500 (or $30,000 if 50 and older). In fact, combined employer and employee contributions to each participant can be up to $66,000 (or $73,500 if 50 and older).

4. Use as a retention tool

Employers have the option to choose a contribution vesting schedule based on the employee’s length of service. If employees leave the company before their contributions are fully vested, they forfeit the unvested portion. Vesting can incentivize retention, as employees receive more contributions to their 401(k) the longer they stay.

5. Great addition to existing 401(k)

Already have a 401(k) plan? Excellent. The profit sharing feature can be easily added to an existing 401(k) plan.

Popular Formulas for 401(k) Profit Sharing Contributions

Flat Dollar Amount Method

This approach is the most basic because every employee receives the same contribution amount. You calculate each eligible employee’s contribution by dividing the profit pool by the number of employees who are eligible for your company’s 401(k) plan.

Example: The company wishes to contribute a total of $20,000 as profit sharing and there are 4 employees. Each employee would receive $5,000, regardless of their salaries.

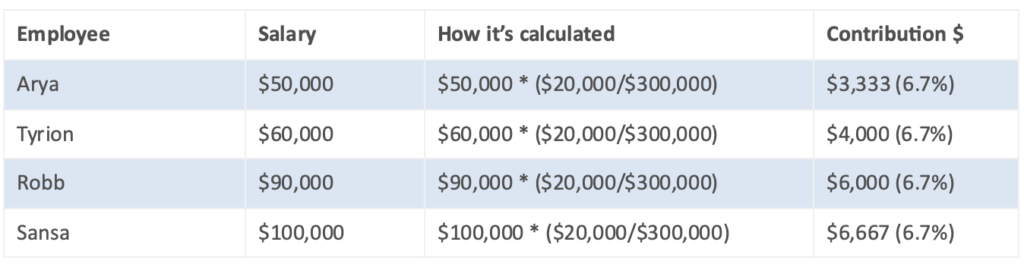

The Pro-Rata Method

Also known as the “comp-to-comp method,” this approach allocates the profit share based on employees’ relative salaries.

Example: The company profit sharing pool is $20,000, and the combined compensation of your four eligible employees is $300,000. As a result, each employee would receive a contribution equal to 6.7% of the employee’s salary.

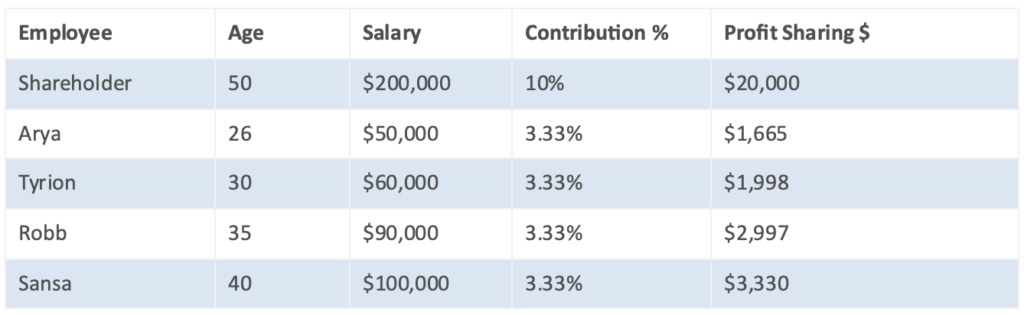

New Comparability

The most flexible type of profit sharing allocation formula, new comparability allows an employer to allocate multiple contribution rates to different employee groups – or even a different contribution rate to each employee. Most employers use this flexibility to allocate larger contribution rates to business owners, or other key employees.

However, to qualify for this flexibility, new comparability allocations must pass a complicated IRS nondiscrimination test (called the “general test”) to prove they don’t discriminate in favor of highly-compensated employees (HCE). Most allocations pass the general test by converting participant contribution rates to a benefit rate at retirement – typically, age 65. This “cross-testing” can make a 15% contribution to a 55-year-old (with 10 years to retirement) as valuable as a 5% contribution to a 30-year-old (with 35 years to retirement) for testing purposes.

Due to “cross-testing,” companies with older business owners are typically the best candidates for new comparability contributions. A spread of 10+ years often does the trick, allowing an employer to maximize owner contributions while allocating just the “gateway minimum” contribution to non-HCEs. The gateway minimum contribution made to all plan non-HCEs must equal the lesser of:

- one-third the highest contribution rate given to any HCE (based on the plan’s definition of compensation)

- 5% of the participant’s gross compensation

If one of your primary 401(k) plan goals is maximizing business owner contributions at the lowest total cost, a new comparability formula can be your best bet. However, due to the general test, this allocation formula may not be available to your company if young HCEs are employed.

Example: The shareholder of a small business is a 50 year old with a high income. Using new comparability, the owner is able to receive a larger profit sharing contribution than the younger and lower income employees.

Using Vesting Schedule to Retain Employees

Many businesses use vesting schedules to detail how long employees must work for the company before they can claim their profit sharing, including when they move to another job or retire. Employees don’t actually own profit sharing portion until the amounts have vested. Employees slowly gain ownership in the profit sharing over time, perhaps 20% each year on a 5-year schedule. Here’s what that would look like:

- 1 year of service, they have 20% ownership

- 2 years of service, they have 40% ownership

- 3 years of service, they have 60% ownership

- 4 years of service, they have 80% ownership

- 5 years of service, they have 100% ownership

If the employee leaves after two years of service, he would only be able to take 40% of the profit sharing with him while the rest would be forfeited. Vesting periods are designed to entice employees to stay with a company as long as possible.

401(k) Profit Sharing vs. 401(k) Match

401(k) profit sharing and 401(k) match are similar but have three key differences:

- Employees receive profit sharing contributions regardless of whether they participate in the plan or not. However, an employee only receives a match if they choose to defer part of their income in the retirement plan.

- Profit sharing contributions are typically a percentage of an employee’s plan-eligible income. In contrast, how much employees contribute to the plan determines the match they will receive.

- Profit sharing 401(k)s allow employers to encourage employees to align their activities with business goals. A business can set the amount of contributions on hitting certain milestones (such as the company’s profits, revenue, product milestones, etc.). The company does not need to make a profit in order to make a profit sharing contribution.

Tying the employer contribution to company performance is one of the biggest differences between 401(k) profit sharing vs. a match.

Limitations to Profit Sharing 401(k) Plans

There are a few limitations to remember when making employer contributions, such as profit sharing:

- Employers can only deduct contributions to retirement plans of up to 25% of total employee compensation.

- Total contributions for each employee (including employer contributions and employee deferrals) may not exceed 100% of the employee’s compensation.

- Total contributions to an employee are also limited to $66,000 for 2023 (or $73,500 if an employee is over age 50).

- For 2023, only annual compensation up to $330,000 can be considered for the calculation of any employer contribution.

Profit sharing contribution helps businesses lower taxes, maximizes owner savings and rewards employees. It’s a great way to thank your employees while being mindful of your finances.

How NESA Can Help

NESA regularly helps businesses design and model retirement plan options allowing decision makers to quickly see whether a Profit Sharing Plan could be a powerful strategy for shareholders and employees.

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.