RETIREMENT PLAN 101

403(b) for Tax-Exempt Organizations, Schools, Churches, and Foundations

Nonprofits are unique—so are their 403(b) plans. At NESA, we’re proud to support organizations making a difference.

What is a 403(b)?

A 403(b) plan is an employer-sponsored retirement savings plan that functions much like the 401(k) plan. What’s unique about a 403(b)? For one, it can only be sponsored by a public school or a 501(c)(3) tax-exempt organization. Second, many of the compliance testing that apply to a 401(k) does not apply to the 403(b), such as ADP and top-heavy testing. There are many benefits to having a 403(b), making it a go-to retirement vehicle for nonprofit organizations.

Who Can Offer a 403(b)?

403(b) plans can be established by two types of organizations:

• Tax-exempt organizations under IRC §501(c)(3)

• Public schools and other public educational institutions

How Does a 403(b) Work?

A 403(b) operates similarly to a 401(k), allowing employees to contribute a portion of their salary on a pre-tax or Roth (after-tax) basis. These contributions are automatically deducted from each paycheck and invested in retirement-focused funds selected by the employee from the plan’s options. Over time, these investments grow, helping employees build a strong financial foundation for retirement.

One of the key benefits of a 403(b) is tax deferral. Traditional 403(b) contributions lower taxable income, and taxes are not paid until funds are withdrawn in retirement. Employees who opt for Roth contributions pay taxes upfront, but qualified withdrawals in retirement are tax-free. Some nonprofit employers may also provide matching or discretionary contributions, further enhancing employee savings.

Why a 403(b) is a Smart Move for Your Nonprofit?

Providing a 403(b) plan is more than just an employee perk—it’s an investment in your organization’s long-term success. Here’s why a 403(b) is a strategic benefit for nonprofits:

Tax Advantages – Maximize Savings for Employers and Employees

• Employer contributions to a 403(b) are tax-deductible, reducing organizational expenses.

• Employee contributions lower taxable income (for pre-tax contributions), providing immediate tax savings.

• Nonprofits may qualify for tax credits when starting a new retirement plan, offsetting administrative costs.

Flexible Plan Design – Tailored for Nonprofits

• Employers can choose whether to offer matching contributions or other employer-funded benefits.

• Plans can be designed with customized eligibility, vesting schedules, and contribution structures.

• Employees have access to both Traditional (pre-tax) and Roth (after-tax) savings options.

Attract & Retain Top Talent – Strengthen Your Workforce

• Employees increasingly prioritize retirement benefits when evaluating job opportunities.

• A well-structured 403(b) plan enhances your organization’s reputation as a competitive and caring employer.

• Reduces turnover and boosts employee satisfaction, helping your nonprofit focus on its mission.

Portability & Long-Term Value – Security for Employees

• Employees can roll over their savings to another 403(b), 401(k), or an IRA if they change jobs.

• Contributions and investment earnings grow tax-deferred, ensuring long-term financial stability.

• Nonprofit leaders can also use a 403(b) for their own retirement planning, making it a valuable tool for executives and staff alike.

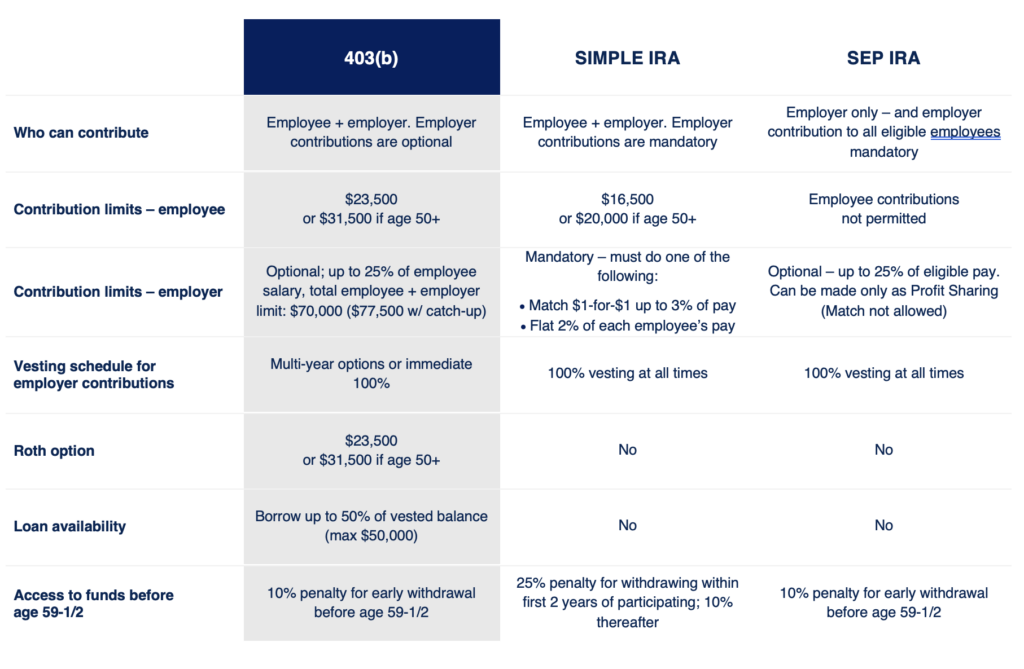

When comparing a 403(b) to SEP IRAs and SIMPLE IRAs, the differences are striking. 403(b)s stand out with higher contribution limits and greater flexibility in design, allowing non-profits to better manage costs. Plus, they provide the added benefit of penalty-free access to funds through loans in case of an emergency. Here’s a quick summary of how these plans stack up:

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.