RETIREMENT PLAN 101

Contributing to Multiple 401(k) Plans

Maximizing Retirement Savings: A Comprehensive Guide to Contributing to Multiple 401(k) Plans

The perennial question of whether one can contribute to more than one retirement plan is a common concern for those juggling multiple jobs or side gigs. The definitive answer is yes, and in this article, we delve into the nuances of contributing to various retirement plans, with a primary focus on 401(k)s, 403(b)s, and Solo 401(k)s, and similar vehicles. While the golden rule is not to exceed the annual limit across all plans, there’s an intriguing twist when considering employer contributions.

Quick Facts

- Increased Contribution Limits: Two 401(k) plans allows you to take advantage of the contribution limits for each plan independently.

- Diversification of Investments: Opportunity to diversify your retirement investments across different employers and potentially different investment options.

- Tax Advantages: Maximize your tax advantages, reducing your taxable income for both your primary employment and side business income.

Candidates for Multiple 401(k) Participation

Individuals positioned to participate in multiple plans typically fall into one of two categories:

1. Employees of Two Separate Businesses: Each offering a 401(k) or a similar defined contribution plan.

2. Employees of One Business with a Side Job: Generating self-employment income, enabling the establishment of a personal employer retirement plan.

Annual IRS Limits

Contributions to 401(k) plans involve individual deferrals and employer contributions, which may include matching or profit-sharing components. Two critical limitations must be considered:

1. IRC Section 402(g): Limits the pre-tax or Roth contribution by the employee, with a 2024 cap of $23,000 ($30,500 for those 50 and older).

2. IRC Section 415(c): Caps total contributions (employee and employer) for each plan separately. The 2024 limit is $69,000 ($76,500 for those 50 and older).

Two 401(k)s: An Illustration

To illustrate the benefits, let’s consider Mike, a 45-year-old tech professional with a side business. As an employee of Tech Company, he earns a W-2 salary of $250,000 and participates in their 401(k) plan. His employer offers a 5% match, plus a sweet 15% profit sharing contribution each year.

Mike also has a non-related side gig that generates $100,000 of net profit via his sole proprietorship. His business offers a Solo 401(k).

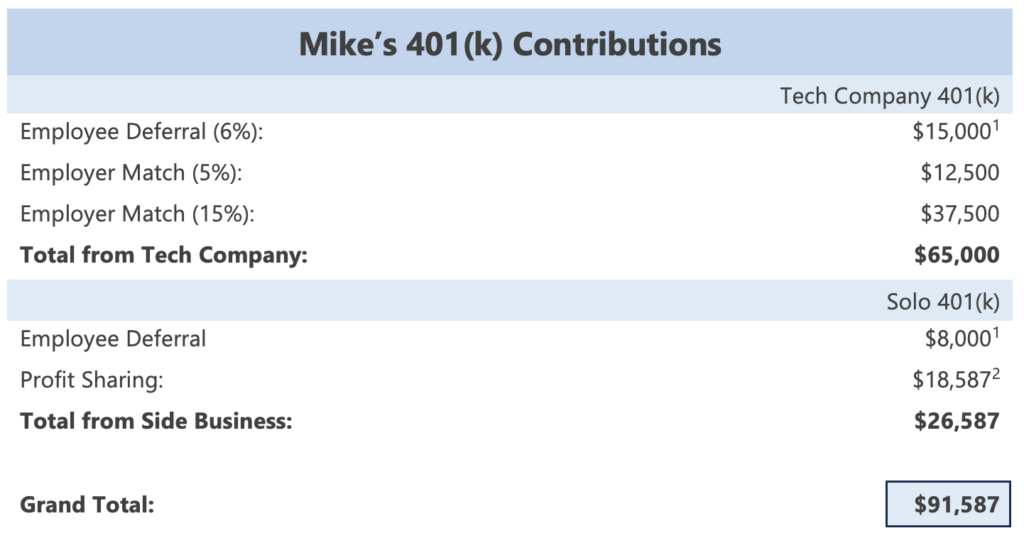

His combined contributions from both his employer’s 401(k) and side gig Solo 401(k) total an impressive $91,587 for the year. Here’s how:

Unrelated Businesses? More Value

In the realm of contributing to multiple 401(k) plans, understanding employer contributions is pivotal. Each unrelated employer’s retirement plan has its own annual contribution limits, covering aspects like profit-sharing and matching.

The key takeaway: While individual contribution limits must be respected, each unrelated employer can contribute up to their plan’s maximum. This flexibility allows for the potential maximization of employer-sponsored retirement benefits, but the actual contribution amount remains subject to your earnings, plan constraints, and other factors.

Related Businesses? Rules Are Different

Entrepreneurs with multiple businesses should be cautious of controlled group rules, designed to prevent owners from creating new companies to exclude employees from retirement plans. Consulting with an advisor is advisable to ensure compliance with IRS and Department of Labor regulations.

Conclusion

In the intricate landscape of contributing to multiple 401(k) plans, understanding IRS limits, employer contributions, and business dynamics is paramount. The potential for substantial savings is undeniable, offering a strategic approach to securing your financial future. As you embark on this journey, consider seeking professional advice to ensure compliance and maximize the benefits of this unique financial strategy. By planning wisely and contributing strategically, you pave the way for a robust retirement portfolio that aligns with your long-term goals.

Footnote(s):

1 Max deferral 2024: $23,000 ($15,000 + $8,000)

2 Self-Employed PS Contribution: $100,000 (net income) – $7,065 (1/2 SE Tax) * 20% = $18,587

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.