Large Plan CPA Audit Requirements

We coordinate and work closely with your auditor on your behalf, giving you an advantage.

Retirement Plan CPA Audit

Your business or organization is growing, and so is your 401(k) or 403(b) employee plan. But when a plan reaches a certain size, it’s required to be audited by an independent accounting firm. Will you be ready, and do you have proper support? This FAQ piece is designed to help you better understand audit requirements and guide you, so you can make informed decisions.

What is the purpose of a 401(k) or 403(b) annual CPA audit?

The Employee Retirement Income Security Act of 1974 (ERISA) requires that certain 401(k) and 403(b) plans be audited annually by an independent qualified public accountant. The primary purpose of the audit? To ensure that the plan is operating in accordance with Department of Labor (DOL) and Internal Revenue Service (IRS) rules and regulations, as well as operating consistent with the plan document and that the plan sponsor is fulfilling their fiduciary duty.

When does a retirement plan need an audit?

Whether or not your plan requires an annual audit is determined by the total number of eligible participants in your plan at the beginning of the plan year. There are three types of eligible participants:

- Current participating employees: they are your existing employees who are eligible and taking part in the plan

- Current non-participating employees: these are also your existing employees who are eligible but elected not to enter the plan (yes, they are counted, too!), and

- Terminated employees: retired, deceased or separated former employees who still have account balances in the plan

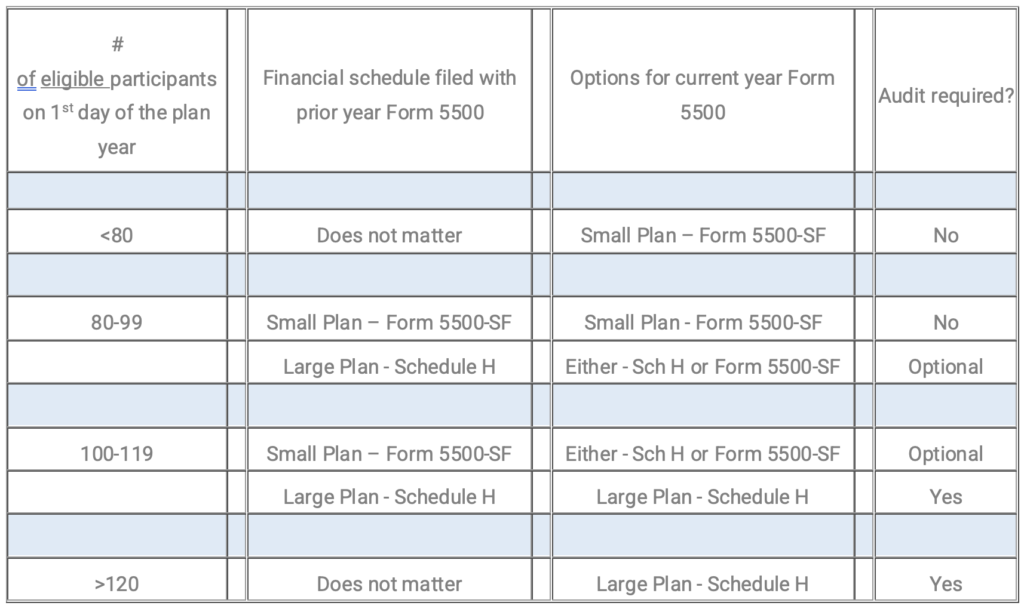

As a rule of thumb, when a plan has more than 100 eligible participants it’s considered a “Large Plan” and, as a result, must file the longer version of the Form 5500 as well as have a plan audit conducted by a certified public accountant.

However, one exception to this general rule is in the 80-120 Rule.

What exactly is the “80-120” exception rule?

The 80-120 rule provides an exception for growing organizations: if a plan has more than 100 eligible participants, but less than 120 and you filed as a “Small Plan” in the previous year, you can remain as a “Small Plan” and file the Short Form 5500 in the current year. This rule will continue to apply until your plan has more than 120 eligible participants. You are not required to conduct a plan audit if you are filing the Short Form 5500.

Here’s a caveat to this rule: if you filed as a “Large Plan” in the previous year and your participant count drops below 100, you are still required to file as a “Large Plan” and have an audit conducted until your eligible participant count drops below 80.

Also, if it’s the first year for your plan and you have over 100 participants, you must file as a Large Plan and attach an audit completed by a certified independent auditor.

As you can see, it is important to review the plan’s eligible participant count before engaging an auditor, especially if the participant count fluctuates between 80 and 120. If your plan falls under the Large Plan filer category, engaging a qualified independent auditor as soon as possible after plan year end is advisable.

How do I prepare for an annual audit?

To get the ball rolling, an auditor will request all plan-related documents, which will likely include:

- Signed plan document or adoption agreement

- Any recent required or discretionary amendments made to the plan

- Most recent IRS determination letter or opinion letter

- Most recent summary plan description

- Copy of the plan’s ERISA fidelity bond insurance

- Copy of the most recent compliance testing performed

- Committee or board minutes that document considerations and decisions about the plan

In general, these documents should be easily accessible and current. That’s why it’s important for plan sponsors to safely keep all applicable plan-related documents, especially if there are changes made.

Moreover, the auditor will need financial reports of your plan, such as participant contribution report, distribution report, fees report, and plan activity report, among others. As part of our fiduciary support services, NESA is able to work directly and collaboratively with you and your auditor and provide the necessary information.

What will take place during an audit?

Once the auditor receives all the necessary documents, they will review and analyze the plan’s operations, internal controls and plan activity. The auditor will select a sample of employees for distributions, loans or rollovers and will request documentation that support such activity. For example, this may include loan applications, distribution paperwork and the image of the check or proof of funds being delivered to the participant.

Once the assessments of the samples and financials are complete, the auditor will draft something called an “accountant’s opinion.” The plan sponsor should carefully review this document, which outlines any control deficiencies found during the audit. The auditor will also provide a final financial statement that must be attached to the plan’s Form 5500 before filing with the DOL.

Are there important deadlines I should know?

Yes! Annual audits should be completed before the Form 5500 filing deadline. Form 5500s are required to be filed by the last day of the seventh month after the plan year ends. For example, if your plan year ends on Dec. 31, your Form 5500 is due on July 31 of the following year. However, you may request an extension with the IRS using Form 5558 to get an additional 2-1/2 months to file, extending the due date from July 31 to October 15 for calendar year plans. It’s critical to meet the required deadline to avoid any DOL or IRS penalties.

Final words

Your trusted retirement plan expert or service provider should be keeping you apprised of the audit status and inform you well in advance if your plan needs an audit. Why? So you can prepare, as you will need to start looking for an auditor and budget for the expense. It’s important you work with a retirement plan specialist that provides you support and advance planning.

How NESA makes your life easier

Managing the compliance requirements and CPA audit of your 401(k) or 403(b) plan can be challenging with so many moving parts; not to mention ever-changing rules and regulations from the DOL and IRS. But it doesn’t have to be that way. NESA can provide you support and do the heavy-lifting:

- Determining whether or not your plan requires annual CPA audit

- If need be, referring you to a trusted and experienced auditor (NESA doesn’t get any commission for referrals, so you know we have your best interest at heart)

- Maintaining your plan documents and amendments, which will be required during the audit

- Coordinating and answering plan document and plan operations questions on your behalf

- Working closely and collaboratively with you and your auditor throughout the year

- You or your auditor need reports or documents from the plan’s recordkeeper or other service providers? We have you covered

With NESA by your side, you can free up more time and focus on what matters most.

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.