RETIREMENT PLAN 101

Retirement Plan Expenses: What Employers Can (and Can’t) Pay with Plan Assets

Fees can be paid by the employer or employees. The choice depends on the philosophy of the business or organization.

Understanding Which Costs Can Be Paid by Your 401(k) or 403(b)

When managing a retirement plan, employers often face a key question: Which expenses can be paid using plan assets, and which should be covered by the employer? The Department of Labor (DOL) and IRS provide guidance on this matter, helping plan sponsors navigate fiduciary responsibilities while ensuring compliance with ERISA regulations.

Understanding the Distinction: Settlor vs. Plan Expenses

Plan-related costs generally fall into two categories:

• Settlor Expenses: These are costs associated with the employer’s business decisions, such as creating, modifying, or terminating a plan. These expenses cannot be paid using plan assets.

• Plan Administrative Expenses: These are ongoing costs related to the plan’s operation and can be paid using plan assets, provided they benefit participants.

Quick Facts

- Employers must cover settlor expenses, including plan setup, design, and non-mandatory amendments.

- Plan assets can pay for administrative costs like recordkeeping, compliance, and investment services.

- However, some expenses, like plan documents and shared technology, fall into a gray area and may be challenged by the DOL.

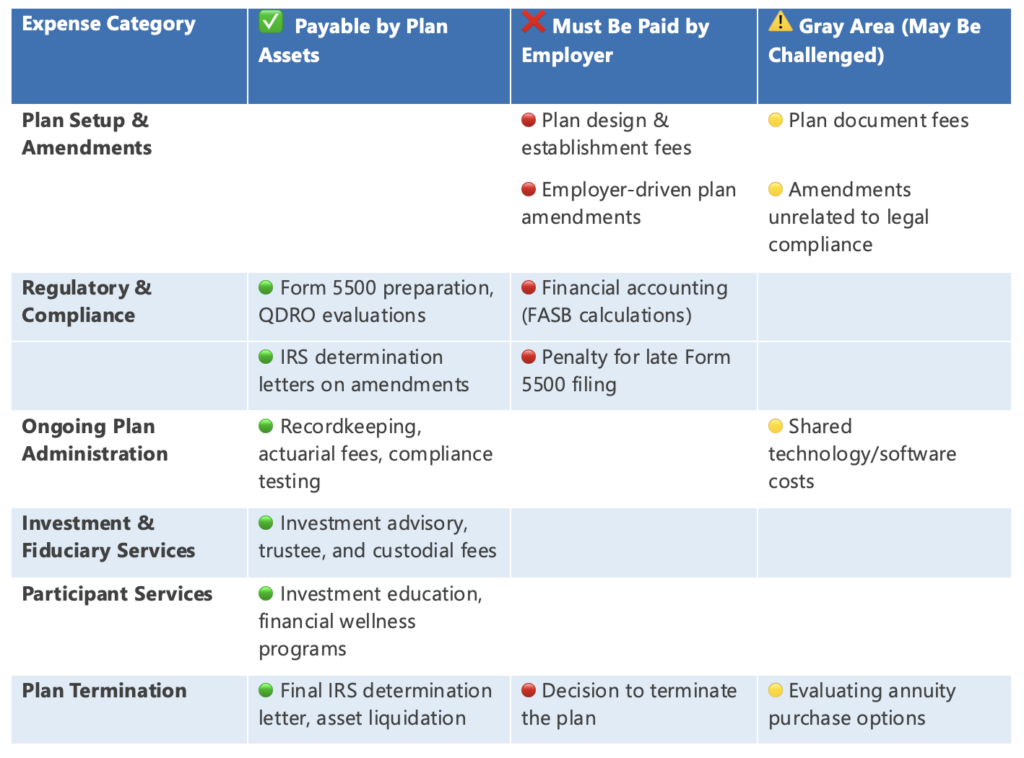

What Expenses Can and Cannot Be Paid by the Plan?

The following breakdown clarifies which costs are permissible to be paid by plan assets and which should remain the employer’s responsibility:

❌ Settlor Expenses (Employer Must Pay)

- Plan design and establishment fees (e.g., legal fees for plan creation)

- Costs for employer-driven plan amendments (e.g., changing benefit formulas for business reasons)

- Financial accounting related to plan sponsorship (e.g., FASB calculations)

- Decisions regarding plan termination (e.g., deciding to terminate, evaluating annuity purchases)

✅ Allowable Plan Expenses (Payable by Plan Assets)

- Annual plan administration (e.g., actuarial fees, recordkeeping, compliance testing)

- Investment-related expenses (e.g., advisory fees, trustee/custodian fees)

- Legal and regulatory compliance (e.g., Form 5500 preparation, QDRO evaluations)

- Participant education and services (e.g., investment advice, financial wellness programs)

- Plan termination implementation (e.g., final IRS determination letter, asset liquidation costs)

⚠️ Expenses in the Gray Area (May Require Caution)

Some costs fall into an “aggressive” category, meaning they might be challenged if paid by the plan. Examples include:

- Plan document fees (DOL has indicated these are typically settlor expenses)

- Shared technology and equipment (e.g., company-wide software, which benefits both the employer and the plan)

- Amendments unrelated to legal compliance

Why This Matters for Employers/ Plan Sponsors

Failing to distinguish between settlor and plan expenses can lead to regulatory scrutiny, potential fiduciary breaches, and costly penalties. Plan fiduciaries must ensure that only legitimate administrative expenses are charged to the plan while keeping settlor expenses separate.

Final Thoughts

Navigating plan expenses requires careful oversight. Employers should consult with legal and financial experts to ensure compliance while maximizing the efficiency of their retirement plan administration. If in doubt, always refer to DOL Advisory Opinions and ERISA guidelines to avoid missteps.

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.