RETIREMENT PLAN 101

401(k) Start-Up Tax Credit

It’s never been a better time for small businesses to start a 401(k).

Tax credit help pay for the cost of starting a new retirement plan.

The federal tax code provides a tax credit that is designed to encourage small employers to establish retirement plans. Created in SECURE Act and further enhanced by SECURE Act 2.0 in Dec. 2022, a small business may claim up to 100% of it’s qualified startup costs for establishing and maintaining a new 401(k) plan. Additionally, the law provides potentially much greater tax credits for those firms that provide an employer match. These tax credits are effective as of January 1, 2023.

Eligible employers

Quick Facts

- Profit sharing contribution is completely optional.

- Eligible costs include plan set up, plan administration and employee education.

- Additional tax credit available for employer contribution.

- A tax credit reduces the amount of taxes you may owe on a dollar-for-dollar basis

Your business can qualify to claim this credit if:

• You have 100 or fewer employees who received at least $5,000 in compensation from you for the preceding year;

• You cover at least one (1) plan participant who was a non-highly compensated employee; and

• In the three (3) tax years before the first year you’re eligible for the credit, your employees didn’t receive contributions or accrue benefits in another plan you sponsored.

A non-Highly Compensated Employee (non-HCE) is an employee who is not considered a Highly Compensated Employee (HCE). An HCE is an individual who:

• Ownership test: An employee is an HCE based on ownership if he or she owns more than 5% of the company sponsoring the plan at any time during the current plan year or during the previous year.

• Compensation test: An employee is an HCE based on compensation if he or she was actually paid more than a set dollar limit ($150,000 for 2023 and $135,000 for 2022) from the company in the immediately preceding year.

Due to the one non-HCE requirement, an owner-only business doesn’t qualify to take advantage of the startup tax credit by adopting a solo 401(k) plan.

Eligible startup costs

• Set up and administer the plan, and

• Educate your employees about the plan.

If you qualify, you may claim the credit using Form 8881, Credit for Small Employer Pension Plan Startup Costs.

Amount of the credit

The amount of credit depends on the number of employees.

Less than 50 employees: an eligible business with 50 or fewer employees may claim a tax credit for 100% of its qualified startup costs (more on this below).

More than 50 employees: an eligible business with 51 to 100 employees may only claim a tax credit for 50% of its qualified startup costs (more on this below).

Eligible tax years

You can claim the credit for each of the first three (3) years of the plan and may choose to start claiming the credit in the tax year before the tax year in which the plan becomes effective.

The credit is part of the general business credit and you may carry it back or forward to other tax years if you can’t use it in the current year.

Maximum tax credit allowed

The maximum tax credit is $5,000 each year, which is decreased for a business with less than 20 employees. The most for businesses with less than 20 employees cannot exceed $250 multiplied the number of non-Highly Compensated Employees (non-HCEs) eligible to participate in the plan. Note that an eligible employer can always claim a tax credit of at least $500 each year.

For instance, a business with a single owner and 18 non-HCEs may receive a tax credit up to $4,500 ($250 x 18).

Or a business with an owner, four (4) managers, and 69 non-HCEs may receive a tax credit up to the $5,000 limit. Recall that a business with over 50 employees can only claim 50% of its qualified startup costs. This means fees incurred by this business to establish and administer the plan would have to exceed $10,000 a year to reach the $5,000 tax credit.

Employer contribution tax credit

As an added bonus, SECURE 2.0 created a tax credit for employer contributions provided by small businesses over the first few years of the 401(k) plan. In order to qualify for this credit, a business must still meet the eligible employer requirements described under the startup tax credit section.

The maximum limit is $1,000 per eligible employee per year. An eligible employee is paid no more than $100,000 a year (adjusted for inflation). The exact tax credit depends upon the number of employees and the number of years since plan startup.

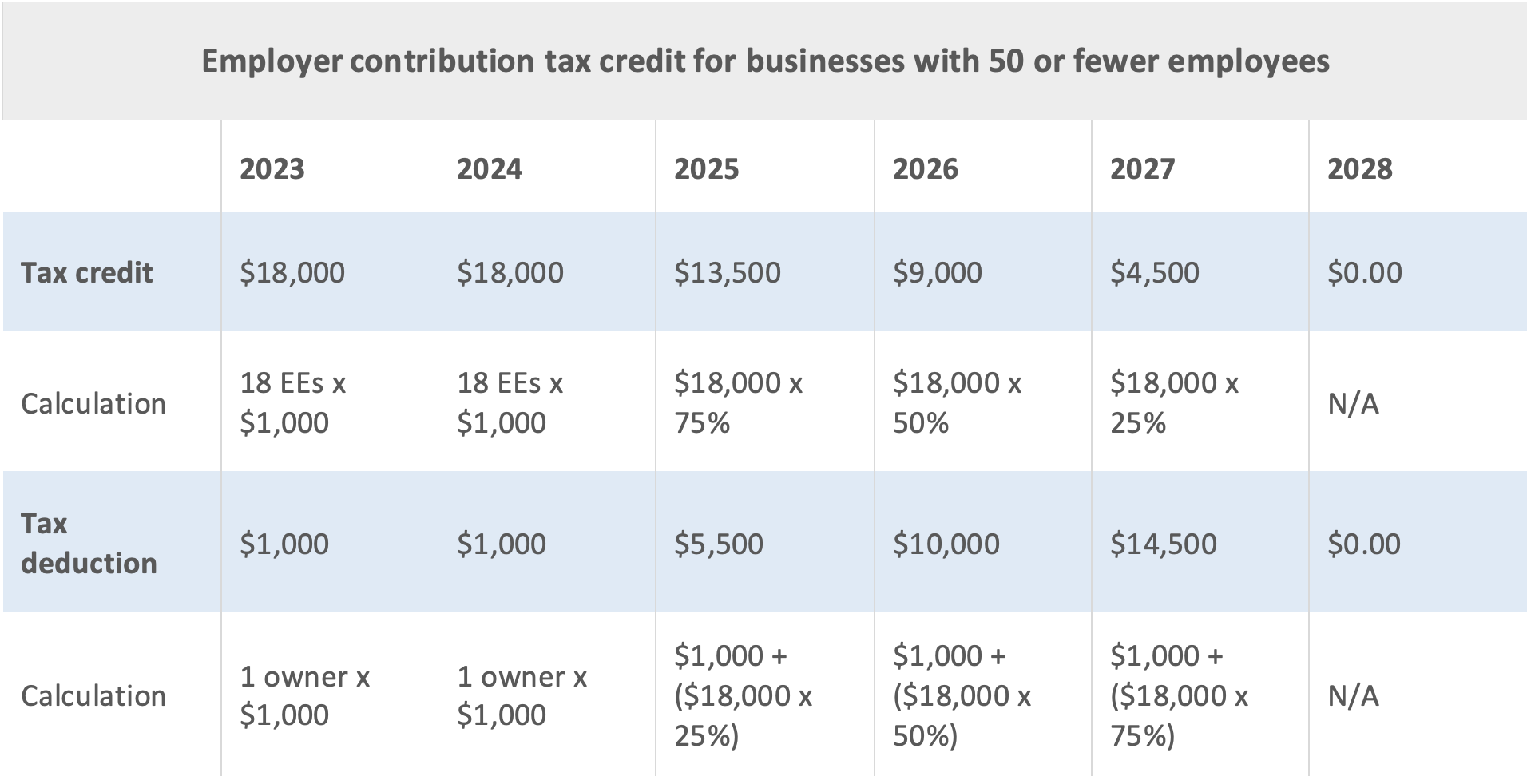

Tax credit for businesses with 50 or fewer employees

A business with 50 or fewer employees may receive a tax credit for 100% of employer contributions in the first two years (including the startup year), 75% of employer contributions in the third year, 50% in the fourth year, and 25% in the fifth year. There is no tax credit available for employer contributions beyond the fifth year of the plan’s startup.

Example in action. A business with a single owner (earning over $100,000) and 18 eligible employees (earning no greater than $100,000) sponsors a 401(k) plan in 2023. Both the plan year and the business fiscal year are the calendar year. The plan permits employee salary deferrals and provides an employer match of 50% of deferrals, but is capped at $1,000. Assuming all 18 eligible employees (EEs) and the owner contribute enough to take advantage of the match, the business would be receiving $63,500 in tax credits over five years:

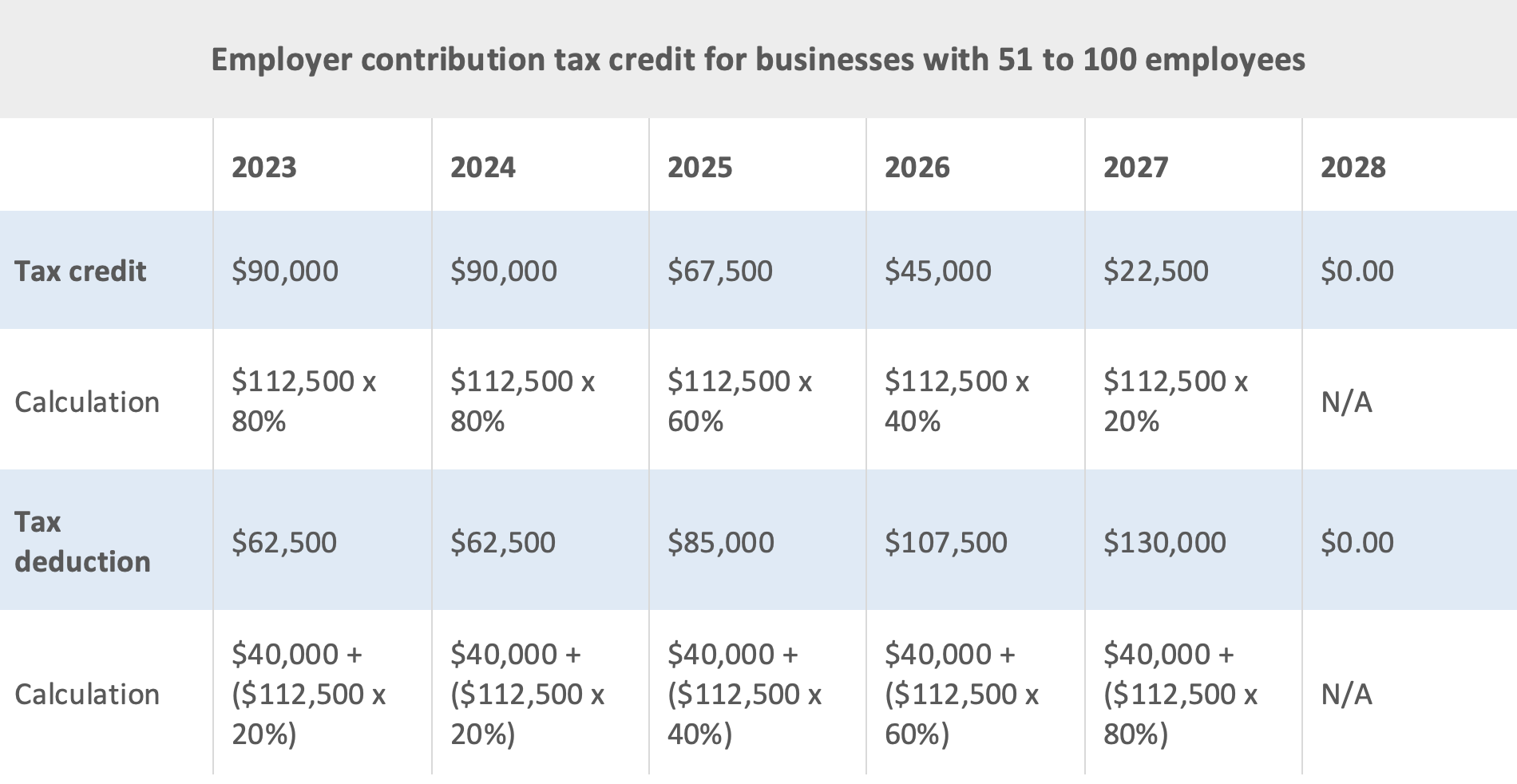

Tax credit for businesses with 51 to 100 employees

The tax credit for a business with 51 to 100 employees is determined on a sliding scale. The percentage is reduced by 2 points for each employee over 50. For example, the tax credit for a business with 90 employees would only be 80% (100% x 2 x 40) of employer contributions for the first two years, 60% (75% x 2 x 40) for the third year, 40% (50% x 2 x 40) for the fourth year and 20% (25% x 2 x 40) in the fifth year. Let’s take the example further. A business with 10 managers (each earning over $100,000) and 80 eligible employees (earning no more than $100,000) starts a 401(k) plan in 2023. Both the plan year and the business fiscal year are the calendar year. The plan allows employee salary deferrals and provides a match of 100% of deferrals up to 2.5% of compensation. Assume total compensation for each year is $1,500,000 for managers and $4,500,000 for eligible employees and all employees defer enough to maximize the match contribution. In this case, the business would be receiving $315,000 in tax credits over five years:

Auto enrollment tax credit

In addition to startup cost tax credit and employer contributions tax credit, small businesses are eligible for a $500 tax credit by adding an automatic enrollment feature to a new or existing 401(k) plan. In order to qualify for this, the auto enrollment feature must meet Eligible Automatic Contribution Arrangement (EACA) requirements. A QACA safe harbor 401(k) plan will also meet EACA requirements. Unlike the startup tax credit, the only requirement to be an eligible employer is having 100 or fewer employees who were paid at least $5,000 in compensation in the preceding year.

New cost savings makes starting a 401(k) worth it

In today’s competitive job market, a 401(k) plan has become “need to” from “want to” for small businesses. And thanks to SECURE 2.0, starting a 401(k) plan is now cheaper and easier than ever. We believe this change is a win-win for both employers and employees, and another step forward in creating a financial independence for millions of hard-working Americans.

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.