EMPLOYER RESOURCES

Retroactive 401(k) Plan Adoption

Thanks to the recent law changes, employers can start a plan in the current year…for the prior year…and get tax deductions.

Retroactive 401(k) Plan Adoption + Business Deadline Considerations + Tax Credit

In December 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law, marking a significant overhaul of employer-sponsored retirement plan regulations. Among its many provisions, one that stands out for employers and employees alike is the ability to retroactively adopt a 401(k)/Profit Sharing Plan. This change offers an opportunity for both employers and employees to bolster their retirement savings strategy. In this article, we’ll delve into what retroactive 401(k) plan adoption entails, how it can benefit individuals and businesses, and the crucial deadlines associated with different business structures.

Understanding Retroactive 401(k) Plan Adoption

Quick Facts

- The SECURE Act allows employers to retroactively adopt 401(k) plans, providing flexibility for businesses to offer retirement benefits without rushing the setup process.

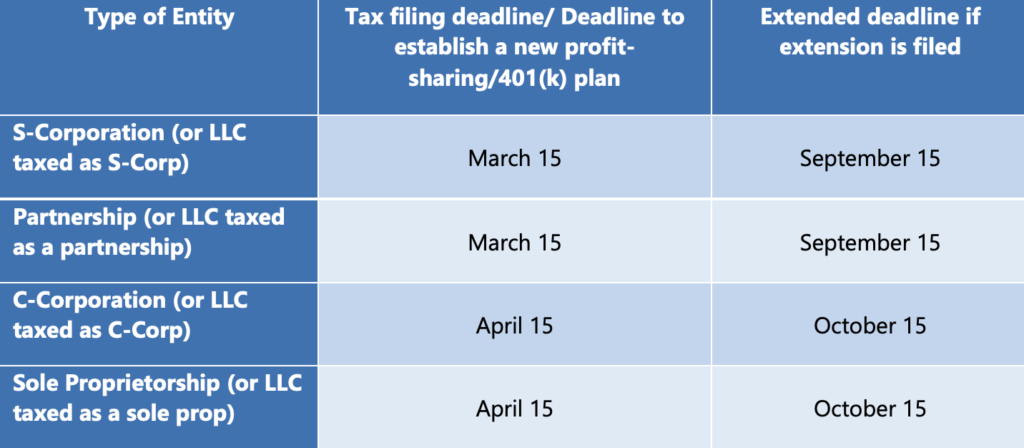

- Deadlines for retroactive plan adoption vary by business structure, with extensions available for S-Corps, partnerships, C-Corps, and sole proprietorships

- Employers may qualify for a tax credit under the SECURE Act, covering up to 100% of the costs of establishing and administering a 401(k) plan, further incentivizing retroactive adoption and promoting financial security for employees.

Traditionally, implementing a 401(k) plan involved a considerable amount of administrative work, including establishing the plan, communicating it to employees, and ensuring compliance with various regulatory requirements. However, the SECURE Act introduced a provision allowing employers to adopt a 401(k) plan retroactively for the previous tax year. This means that businesses can establish a 401(k) plan after the end of the tax year but before the employer’s tax filing deadline, typically the business’s tax return due date, including extensions.

Benefits for Employers

The ability to retroactively adopt a 401(k) plan provides several benefits for employers. Firstly, it allows small businesses or those newly formed to offer retirement benefits to their employees without the need to rush through the setup process. This can be particularly advantageous for startups or businesses experiencing rapid growth, as it provides flexibility in managing administrative tasks while still providing valuable benefits to employees.

Additionally, retroactive adoption enables employers to take advantage of tax benefits associated with 401(k) plans, such as deductible employer contributions and potential tax credits for startup costs. By retroactively adopting a plan, businesses can optimize their tax strategies and potentially reduce their tax liabilities for the previous tax year.

Benefits for Employees

For employees, retroactive adoption of a 401(k) plan presents an opportunity to start saving for retirement sooner rather than later. Many individuals may not have access to an employer-sponsored retirement plan, especially if they work for small businesses or startups. By retroactively adopting a 401(k) plan, employers can offer employees a valuable benefit that helps them save for their future.

Moreover, employees can take advantage of tax-deferred contributions to their 401(k) accounts, allowing them to lower their taxable income for the year in which contributions are made. This can result in immediate tax savings and accelerated growth of retirement savings over time.

Considerations for Employers and Employees

While retroactive adoption of a 401(k) plan offers significant benefits, there are some considerations for both employers and employees to keep in mind. Employers should ensure that they meet all eligibility requirements and comply with relevant regulations when establishing a retroactive plan. This may involve consulting with financial advisors or retirement plan administrators to navigate the process effectively.

Employees should carefully review the terms of the retroactively adopted 401(k) plan, including contribution limits, investment options, and employer matching contributions, if available. It’s essential to take full advantage of the benefits offered by the plan to maximize retirement savings potential.

Tax Credit

Businesses that choose to adopt a 401(k) plan, whether retroactively or otherwise, may also be eligible for a valuable tax credit under the SECURE Act 2.0. This tax credit, known as the Retirement Plan Startup Cost Tax Credit, aims to incentivize small businesses to establish retirement plans for their employees. The credit can amount to up to $5,000 per year for the first three years of the plan’s existence, potentially covering 100% of the ordinary and necessary costs of establishing and administering the plan. By taking advantage of this tax credit, businesses not only benefit from offering a valuable employee benefit but also receive financial support in offsetting the initial expenses associated with setting up the plan. This further underscores the attractiveness of retroactively adopting a 401(k) plan, as it can potentially result in substantial tax savings for qualifying businesses.

Business Deadline Considerations

The deadlines for adopting a retroactive 401(k) plan vary based on the business structure:

Conclusion

The retroactive adoption of 401(k) plans under the SECURE Act, coupled with the flexibility provided by different business deadlines, offers a powerful tool for employers and employees to enhance their retirement savings strategy. By understanding the nuances of retroactive plan adoption and adhering to the appropriate deadlines, businesses can make the most of this opportunity to promote financial security in the later years of life.

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.