RETIREMENT PLAN 101

Safe Harbor Plans

Safe Harbor to the Rescue

In the complex world of retirement planning, achieving fairness and security for all employees is paramount. The repercussions of failed testing in 401(k) or 403(b) plans extend far beyond administrative challenges, profoundly impacting the retirement prospects of key executives. Fortunately, there exists a remedy: Safe Harbor Plans.

Quick Facts

- Safe Harbor Plans exempt employers from annual non-discrimination testing, simplifying plan administration and reducing the risk of compliance failures.

- Safe Harbor Plans offer various contribution options, such as matching and non-elective contributions, allowing employers to tailor plans to meet their strategic goals.

Understanding Safe Harbor Plans

A Safe Harbor Plan is a strategic framework within a retirement plan that empowers employers to bypass the intricacies of annual compliance tests. By mandating employer contributions that are immediately vested, Safe Harbor Plans create a level playing field, ensuring all participants enjoy a fair and secure retirement landscape.

Exploring Safe Harbor Options

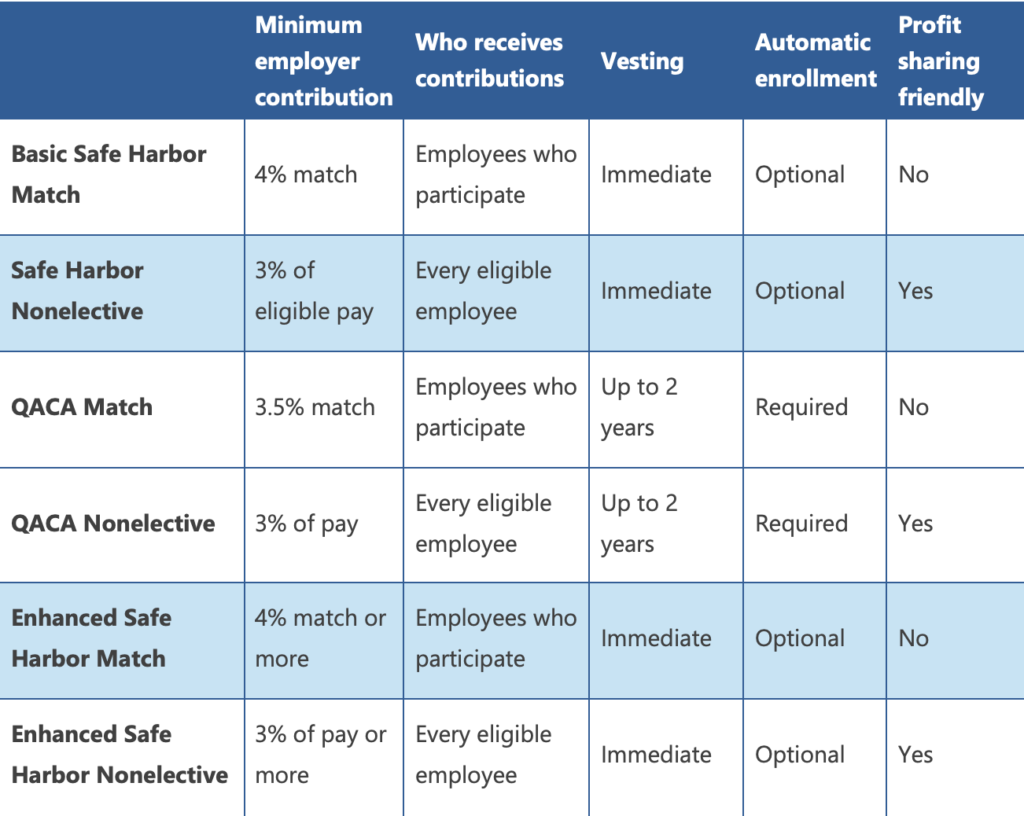

There are several avenues within Safe Harbor Plans, each tailored to meet diverse organizational needs:

1. Basic Safe Harbor Match: Employers match 100% of the first 3% of each employee’s contribution, along with 50% of the next 2%. Immediate vesting is required.

2. Safe Harbor Nonelective: This option involves an annual employer contribution of 3% of each eligible employee’s compensation, irrespective of their own contributions. Immediate vesting applies.

3. Enhanced Safe Harbor Match: Here, employers match 100% of the first 4% of each employee’s contribution, with full vesting required.

4. Enhanced Safe Harbor Non-Elective: Employers make a higher non-elective contribution, typically exceeding the standard 3%, to all eligible employees. Full vesting is necessary.

5. Qualified Automatic Contribution Arrangement (QACA) Match: This match varies from traditional Safe Harbor options, with a lower minimum required match and the option for vesting:

- A lower minimum required match (3.5% with QACA Match vs. 4% with a traditional Safe Harbor options)

- The option to vest contributions

- Employers adopting this must implement automatic enrollment

6. Qualified Automatic Contribution Arrangement (QACA) Non-Elective: Similar to QACA Match but with a mandatory 3% employer contribution, regardless of employee contributions. Vesting schedules of up to 2 years can be added.

Benefits of Implementing Safe Harbor

The advantages of integrating a Safe Harbor provision into your retirement plan are manifold:

- Streamlined Compliance: Safe Harbor provisions alleviate the need for extensive annual non-discrimination testing, notably the ADP/ACP and top-heavy tests.

- Maximized Savings: By structuring employer contributions, highly compensated employees can maximize retirement savings without constraints.

- Tax Efficiency: Employer contributions reduce taxable income for the organization, fostering financial health.

When to Consider Safe Harbor

Safe Harbor provisions offer an appealing option in various scenarios:

- Post-Testing Failures: In the aftermath of failed non-discrimination testing, Safe Harbor swiftly rectifies compliance issues.

- Maximization Concerns: When highly compensated employees face limitations due to testing concerns, Safe Harbor provides an attractive solution.

- Mandatory Contributions: For organizations seeking structured and compliant avenues for employer contributions, Safe Harbor is an ideal choice.

Timing Requirements for Implementing a Safe Harbor Contribution Provision in a New or Existing 401(k) Plan

Understanding the timeline for including a safe harbor contribution feature in a new or existing 401(k) plan is crucial for employers. Below are the detailed timing requirements:

For a Brand New 401(k) Plan

When establishing a new 401(k) plan, certain steps must be followed to incorporate a safe harbor contribution provision:

1. Employee Participation Window: Employees must be able to start making 401(k) salary deferral contributions for at least the final three months of the year, commencing no later than the first payroll of October for a calendar year plan.

2. Adoption of Safe Harbor Provision:

- If adopted by October 1st: The safe harbor contribution is funded on compensation paid from October 1st through December 31st. The contribution method can be either a 3% nonelective or 4% match for the initial plan year.

- If adopted after October 1st but before December 2nd: Only the safe harbor nonelective contribution method can be utilized for the initial plan year, equal to at least 3% of eligible employees’ plan compensation.

- If adopted on December 2nd or later: Only the safe harbor nonelective contribution method is available for the initial plan year, equal to at least 4% of eligible employees’ plan compensation. A plan amendment adding the safe harbor provision for the initial plan year is not required until the end of the following plan year.

For an Existing 401(k) Plan

For an existing plan, the timing requirements differ:

1. Safe Harbor Notice: If adding a safe harbor matching provision, employees must receive a “safe harbor notice” describing the new safe harbor match no later than December 2nd of the prior year.

2. Adoption of Safe Harbor Provision:

- If added before December 2nd: The safe harbor contribution for the first year must be nonelective and equal to at least 3% of eligible employees’ plan compensation for the plan year.

- If added on or after December 2nd: The safe harbor contribution for the first year must also be nonelective and equal to at least 4% of eligible employees’ plan compensation for the plan year. Similar to a new plan, the plan amendment doesn’t need to be adopted until the end of the following plan year.

Taking Advantage of SECURE Act 2.0 Tax Credits

The 2022 SECURE Act 2.0 has enhanced the attractiveness of Safe Harbor plans, particularly for small businesses, through expanded tax credits and plan design flexibility. These tax credits cover startup costs and employer contributions, offering substantial benefits over multiple years.

Startup cost tax credit

The secure act may cover up to 100% of employer costs for a new 401(k) for the first three years ($250 per NHCE) for employers with fewer than 50 employees. Employers with more than 50 employees also receive the $250 per NHCE; however, their credit is limited to 50% of qualified employer costs. You can estimate your potential Secure Act tax credits here.

Employer contribution tax credit

Employers may also be eligible for an additional $1,000 tax credit per employee for contributions to the employee’s account. However, this tax credit only applies to contributions to employees that make less than $100,000 in 2023 (indexed for inflation).

Conclusion

In essence, Safe Harbor provisions provide a cornerstone for equitable, compliant, and stable retirement planning. However, the importance of selecting the right Safe Harbor option cannot be overstated. Choosing the optimal plan tailored to specific organizational needs maximizes benefits while minimizing risks. Given the intricacies involved, partnering with a knowledgeable retirement plan specialist, such as NESA, becomes a strategic decision. We can ensure that every aspect of the plan is meticulously tailored, enhancing outcomes for both employers and employees alike. Opting for Safe Harbor today, with the guidance of seasoned professionals, lays the groundwork for a brighter, more assured tomorrow for everyone involved.

Find the Right Plan for Your Business or Nonprofit

NESA Plan Consultants (NESA) is a retirement plan provider working with advisors, recordkeepers and CPAs to offer customized 401(k), 403(b) and 457(b) plans. NESA offers modern solutions and provides resources to employers and employees to secure a brighter financial future.