RETIREMENT PLAN 101

Solo 401(k) Plans – Save More, Pay Less in Taxes

If you’re self-employed, a Solo 401(k) is your secret weapon for retirement savings. It lets you stash away significantly more than an IRA—up to $70,000 per year—while scoring major tax advantages. That means keeping more of your hard-earned money while planning for the future.

What is a Solo 401(k)?

A Solo 401(k) (also dubbed an Individual 401(k)) is designed specifically for self-employed business owners and their spouses. What makes it special? You get to contribute as both the employer and the employee, maximizing your savings and reducing your taxable income at the same time.

Bonus perks:

✔ Roth 401(k) option – No income limits, so you can contribute regardless of how much you earn.

✔ Access to funds – Need cash in an emergency? You can take a loan from your Solo 401(k) without penalties.

You can also choose to contribute as an employee to the Roth 401(k) feature no matter how much you earn and also have access to your money via loan without penalty in case of an emergency.

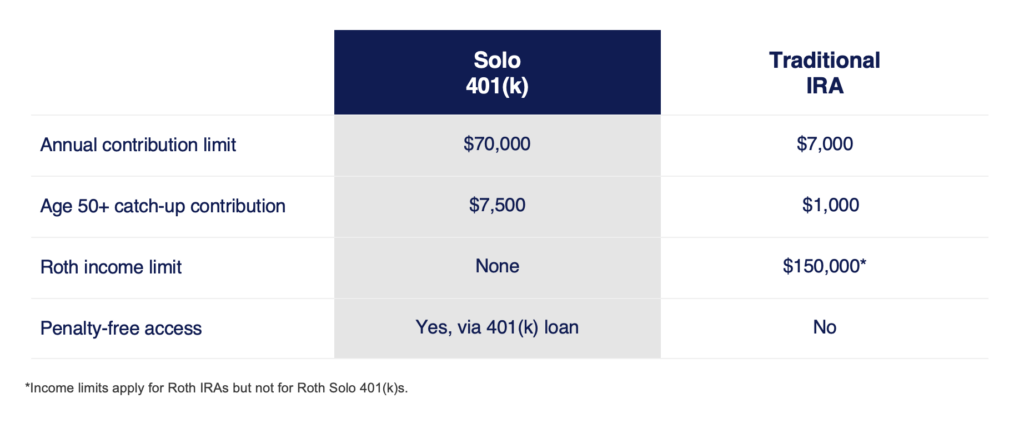

As you can see, Solo 401(k)s offer some significant advantages over Traditional IRAs:

How a Small Business Owner Can Save Thousands in Taxes a Year with a Solo 401(k)

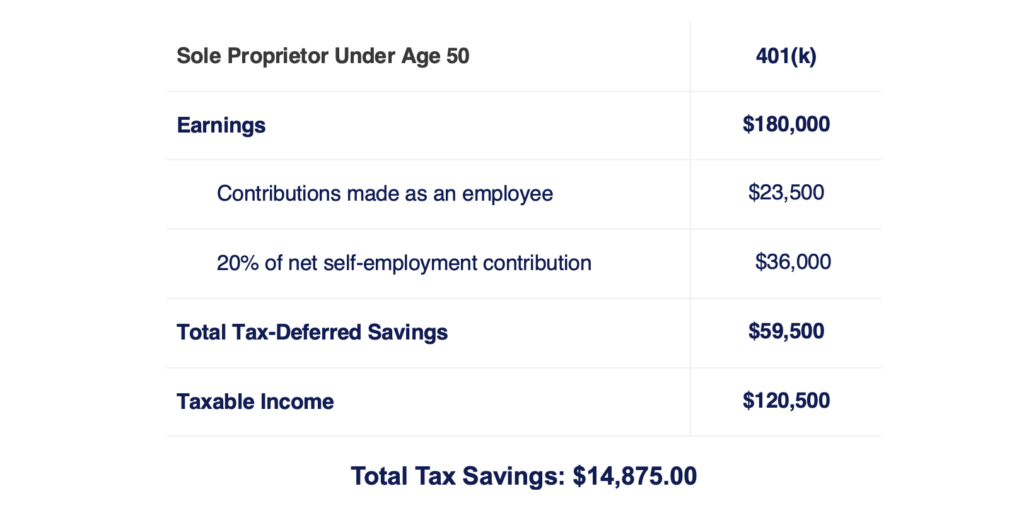

Here’s a hypothetical example of how an owner under age 50 can make contributions to a Solo 401(k) and lower taxable income:

While the owner earned $180,000, only $120,500 is taxable by the IRS. Assuming an effective tax rate of 25 percent, that’s $14,875 in tax savings ($180,000 x 0.25 = $45,000; $120,500 x 0.25 = 30,125; $45,000 – $30,125 = $14,875).

Age 50+? Owners who are 50+ could tax-defer up to $77,500 in earnings this calendar year depending on your earnings. If your business is established as a corporation, you may be able to deduct 25% of W-2 earnings.

This is not intended as tax advice. Be sure to consult a tax advisor to discuss your specific situation.

Solo 401(k) FAQs

- Self-employed business owners (including sole proprietors, LLCs, and S-Corps).

- Business owners with no full-time employees (except a spouse).

- Anyone looking to contribute more than $7,000 annually (the IRA limit).

Businesses with full-time employees (working 1,000+ hours per year) generally cannot offer a Solo 401(k).

Good news: If your business grows and hires employees, your Solo 401(k) can be upgraded to a full 401(k) plan.

Plan Establishment: Must be set up by December 31 to qualify for the current year’s tax benefits.

- Contribution Deadlines:

Employee contributions (including Roth or pre-tax) must be made by the end of the business tax year. - Employer contributions can be made up until your tax filing deadline (April 15 for most).

Absolutely! You can roll over funds from an IRA or a previous employer’s 401(k) into your new Solo 401(k).

Need cash? You can take a loan of up to 50% of your vested account balance (max $50,000).

Early withdrawals? If you withdraw funds (other than a loan) before age 59½, there’s a 10% penalty plus taxes.

Not until your account reaches $250,000+ in assets—then you’ll need to file IRS Form 5500 annual return/report.

Find the Right Plan for Your Business or Nonprofit

NESA simplifies retirement planning by partnering with financial advisors, CPAs, recordkeepers, and industry professionals to create tailored workplace retirement solutions. From small businesses to mid-sized companies, nonprofits, and self-employed individuals, we help organizations provide meaningful retirement benefits—ensuring employees and business owners alike can save with confidence and peace of mind.