Key Takeaways

- The updated Form 5500 rule now counts only participants with account balances at the beginning of the plan year to determine the need for an audit, potentially reducing audit requirements for many 401(k) and 403(b) plans.

- The change in the counting method is expected to eliminate the audit requirement for approximately 20,000 plans, saving businesses thousands of dollars annually on audit costs.

- Despite fewer plans needing audits, audits can still be beneficial by uncovering hidden issues, ensuring compliance, and improving the overall effectiveness of retirement plans.

The Department of Labor (DOL) and the IRS have decided to shake things up with a makeover for the Form 5500, the must-file annual report for employee benefit plans. Starting January 1, 2023, a new counting method for participants is changing the game. Gone are the days of counting everyone and their grandmother who ever glanced at a 401(k) or 403(b). Now, it’s all about who’s actually got skin in the game—participants with account balances. This update could mean fewer plans need audits by an independent qualified public accountant (IQPA), allowing businesses to focus more on growth and less on crunching numbers.

Out With the Old: The Old-School Counting Method

Previously, if a retirement plan had 100 or more participants at the start of the plan year, it was generally stuck with the “large plan” label and an audit requirement. “Participants” included not only active contributors but also all eligible employees and anyone with a balance, even those no longer contributing. This meant more headcount and potentially more headaches.

There was a silver lining in the form of the “80-120 Participant Rule.” If a participant count fell between 80 and 120, and the plan filed as a large or small plan the previous year, it could continue to do so, like a free pass, though it didn’t always ease the audit burden.

In With the New: The Modern Counting Method (Effective January 1, 2023)

Now, the DOL has shifted focus to actual account holders. The new rule counts only those with account balances at the beginning of the plan year to determine if a plan hits the 100-participant mark. This means that if a plan is like a party with only a few people actively dancing and many just observing, only the dancers count.

This revamp means that many plans previously required to undergo an audit (due to inflated participant counts including eligible but non-contributing members) might now avoid it altogether. For newly established plans in 2023, participant counting will be based on year-end figures, making the transition even smoother.

The Big Impact

The new rule is estimated to free approximately 20,000 plans from the mandatory audits. For small businesses, this means more cash at hand and less time and effort spent on compliance.

The Silver Lining of Audits

While escaping the annual audit can seem like a victory, it’s worth noting that a 401(k) or 403(b) audit isn’t always a bad thing. In fact, audits can serve as a valuable tool to uncover hidden issues within the plan and ensure everything is running smoothly. They can reveal compliance problems, operational inefficiencies, and areas needing improvement. By addressing these findings, plan sponsors can enhance the overall effectiveness of their retirement plans, potentially leading to better outcomes for participants and ensuring the plan remains robust and compliant with regulatory requirements.

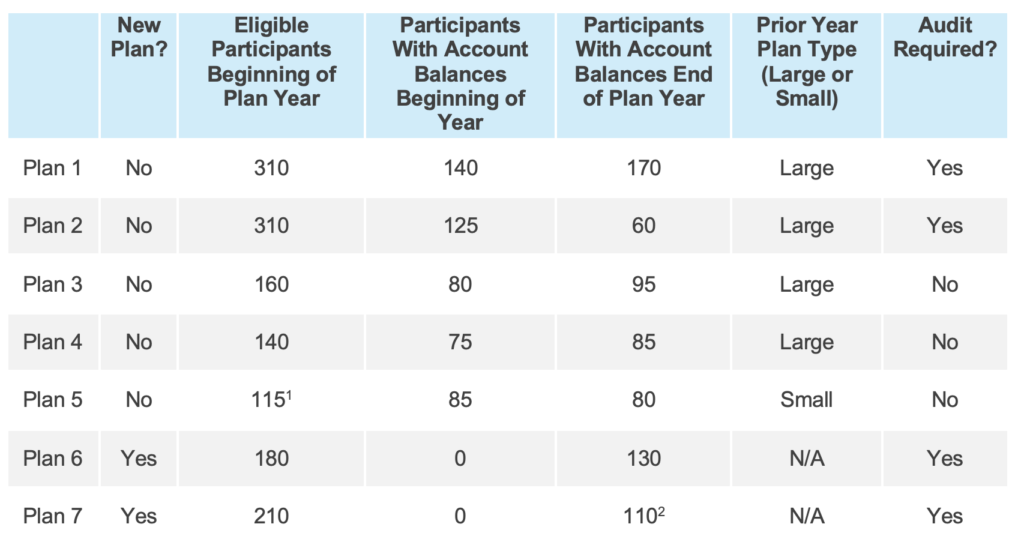

Practical Examples

Let’s see how the new rule shakes out:

Tips for Plan Sponsors

- Trim the Participant List: If possible, cash out terminated participants with balances under $7,000. This helps keep the participant count—and stress level—low.

- Plan Ahead: If a plan requires an audit, it’s crucial to get an auditor lined up and ready well before the filing deadline.

- Engage a Retirement Plan Specialist: Working with a specialist can help navigate the new regulations, optimize the plan, and ensure compliance. They can also help identify strategies to maintain the participant count below audit thresholds.

Conclusion

The new Form 5500 rule for counting participants is a game-changer, especially for small businesses. By focusing on actual account balances rather than mere eligibility, it reduces the frequency of audits and allows businesses to channel their resources more wisely. However, if a plan still requires an IQPA audit, NESA is here to help! NESA specializes in 401(k) and 403(b) plans requiring these audits and collaborates directly with the auditor on behalf of clients to streamline the process and make life easier. Celebrate this regulatory refresh and enjoy the audit-free breeze it might bring—or let NESA handle the audits while focusing on business growth!

- Plan 5 never had more than 120 participants in the plan and therefore always utilized the 80-120 rule to be exempt from the audit requirement.

- Plan 7 has an audit requirement since it has 100 or more participants with account balances as of the end of their first year. They would not be able to apply the 80-120 rule and use the threshold of 120 since they would not have had a prior-year filing.

This is for educational purposes only. The information provided here is intended to help you understand the general issue and does not constitute any tax, investment or legal advice. Consult your financial, tax or legal advisor regarding your own unique situation and your company’s benefits representative for rules specific to your plan.

About the Author

Mizan J. Rahman brings over 15 years of seasoned expertise to the realm of workplace retirement plan benefits programs. Dedicated to assisting small businesses and nonprofits, Mizan is passionate about fostering a secure financial future for hard-working Americans. His comprehensive skill set encompasses compliance, administration, design, and legal documentation of 401(k), 403(b), and 457(b) plans, tailored specifically to the unique needs of these organizations. As an esteemed Enrolled Retirement Plan Agent (“ERPA”) recognized by the Internal Revenue Service, Mizan not only provides personalized consulting but also serves as a trusted advocate during audits by the Department of Labor (DOL) and the IRS, ensuring the utmost protection for his clients’ interests.

Ready to Work with NESA? Or Have a Question?